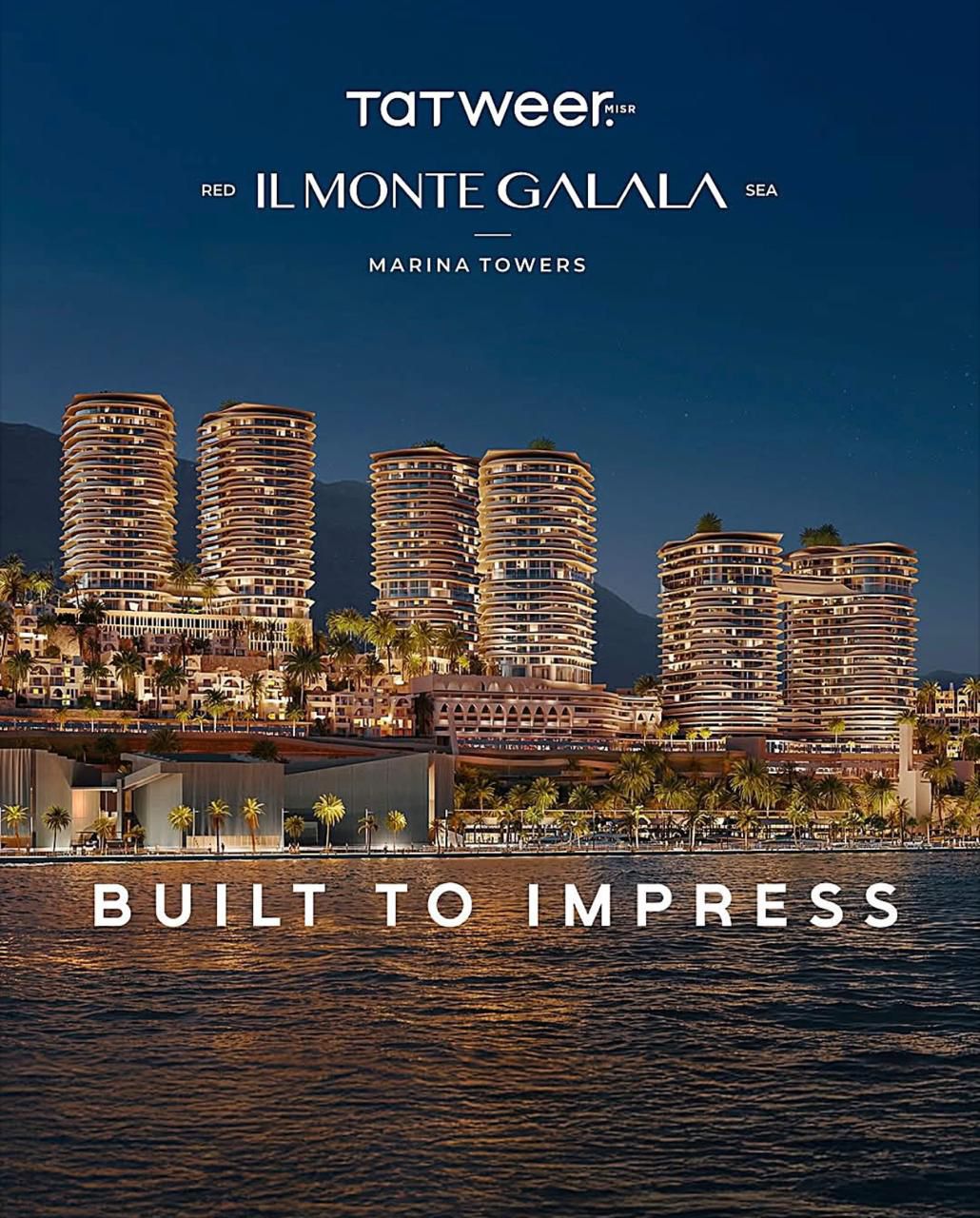

When a developer of the scale of Tatweer Misr Galala Ain Sokhna investment enters a coastal market, it is not simply the launch of a new project.

It is a market signal.

The presence of Tatweer Misr in El Galala along the Ain Sokhna coastline represents a structural shift not just additional supply.

Large developers do not move based on trends.

They move based on long-term data, demand forecasting, and capital allocation strategies.

In investment terms, this is what we call validation.

Tatweer Misr Galala Ain Sokhna Investment as Market Validation

Validation of the Area

One of the most important implications of Tatweer Misr Galala Ain Sokhna investment is area validation.

When a developer of this scale commits significant capital to a destination, it signals:

-

Real demand studies have been conducted

-

Growth forecasts justify long-term presence

-

Infrastructure alignment exists

-

Purchasing power has been measured

-

Liquidity expectations are realistic

Major developers do not enter emerging coastal markets to follow temporary trends. Their investment cycles often extend 7–15 years, meaning their entry is based on confidence in sustained absorption rates.

In simple terms:

If institutional capital believes in the area, it changes the perception of risk for individual investors.

Why Large Developers Rarely “Follow Trends”

Smaller developers may respond to momentum or social buzz.

Large developers operate differently.

A company like Tatweer Misr typically bases expansion decisions on:

-

Land banking strategies

-

Infrastructure proximity

-

Government development alignment

-

Demographic purchasing data

-

Comparative coastal pricing

The move into El Galala indicates belief in:

-

Long-term coastal repositioning

-

Demand migration from North Coast seasonality

-

Weekend-home evolution into lifestyle ownership

-

Capital appreciation waves

This transforms El Galala from a secondary coastal option into a structured investment corridor.

Tatweer Misr Galala Ain Sokhna Investment and Price Uplift

One of the most immediate effects of Tatweer Misr Galala Ain Sokhna investment is value uplift in surrounding projects.

When a strong developer enters a coastal zone, three things usually happen:

Infrastructure Upgrade

-

Improved roads and access

-

Stronger utilities integration

-

Landscape and visual improvement

-

Destination branding

Service Level Elevation

-

Higher hospitality standards

-

Retail and F&B improvement

-

Enhanced security and gated planning

Price Benchmark Shift

-

Increased average meter price

-

Re-pricing of neighboring developments

-

Stronger resale confidence

In real estate economics, this phenomenon is often described as “benchmark reset.”

When a premium project launches, it raises the psychological and financial ceiling of the entire area.

Tatweer Misr Galala Ain Sokhna Investment and Early Entry Advantage

For investors already positioned in El Galala or Ain Sokhna, the entry of a developer like Tatweer Misr creates an early-entry advantage.

Historically in coastal markets:

-

Early buyers benefit from future infrastructure waves

-

Capital appreciation accelerates after institutional validation

-

Rental demand improves as area branding strengthens

This dynamic has been observed repeatedly across Egyptian coastal markets.

The entry of institutional capital reduces perceived risk and increases buyer confidence.

Repricing Waves in Coastal Markets

Coastal Markets Move in Waves

One of the most important aspects of Tatweer Misr Galala Ain Sokhna investment is its impact on pricing cycles.

Coastal destinations typically evolve in waves:

-

Discovery phase

-

Early developer entry

-

Infrastructure development

-

Major developer validation

-

Repricing wave

-

Maturity phase

Each large developer entry often triggers a new pricing wave.

Why?

Because pricing in coastal real estate is not only supply-driven. It is expectation-driven.

When expectations shift upward, pricing follows.

Institutional Entry as a Risk Indicator

Institutional-grade developers operate under capital discipline.

They consider:

-

Absorption rates

-

Long-term ROI

-

Land-to-construction cost ratios

-

Brand impact on resale liquidity

Their presence signals:

-

Reduced speculative risk

-

Structured phasing strategy

-

Market confidence

In global markets, institutional validation often precedes long-term value consolidation.

The Strategic Importance of El Galala , Ain Sokhna

El Galala’s strategic strength lies in:

-

Proximity to Cairo

-

Weekend accessibility

-

Mountain and sea combination

-

Government-backed infrastructure

-

Expansion potential

Unlike remote seasonal resorts, Ain Sokhna serves both primary residence and second-home markets.

This hybrid demand model increases liquidity potential.

Tatweer Misr Galala Ain Sokhna Investment and Long-Term Positioning

The entry of a large developer does not only impact short-term pricing.

It influences:

-

Branding perception

-

Media exposure

-

Broker activity

-

Financing confidence

-

Buyer sentiment

These factors collectively shape long-term value creation.

Coastal markets that attract multiple tier-one developers typically:

-

Experience phased appreciation

-

Maintain higher resale stability

-

Achieve stronger rental benchmarks

-

Attract institutional buyers

What This Means for Investors

If you analyze Tatweer Misr Galala Ain Sokhna investment through an investor lens, the implications are clear:

-

The area has passed initial validation

-

Pricing waves may accelerate

-

Infrastructure momentum is likely to increase

-

Liquidity perception improves

For early-stage investors, this is often considered a signal phase.

For late-stage buyers, it marks the beginning of re-pricing.

Final Thoughts

The entry of Tatweer Misr into El Galala is not merely a project announcement.

It is a structural market message.

It reflects:

-

Confidence in coastal demand

-

Institutional belief in long-term growth

-

Strategic capital allocation

-

Anticipation of future pricing waves

In coastal real estate, large developer movement often precedes area transformation.

The question for investors is not whether the market will move ,

but whether they are positioned before the wave or after it.

If you are analyzing coastal investment corridors and want a structured breakdown of:

-

Current pricing benchmarks

-

Early-entry opportunities

-

Comparative meter values

-

Capital appreciation scenarios

Our advisory team can provide a tailored market brief.

Join The Discussion